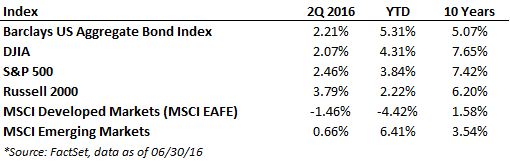

Stocks continued their resilient march upward in the 2nd quarter despite heightened volatility surrounding the Brexit vote. The UK referendum on whether to exit the European Union caught the markets leaning the wrong way (a rare occurrence) and gave global markets a good shake. Nevertheless, after two days of selling, the markets started a rally that continues at the time of this writing. U.S. equities, via the S&P 500, closed the 2nd quarter with a 2.46% gain. In addition to the Brexit vote, stocks have endured a military coup attempt in Turkey, multiple acts of terrorism and other attacks, increased violence against police officers in the U.S., a very disappointing jobs report, two political national conventions and even record heat. Stocks really do climb a wall of worry. While the impact of Brexit on the U.S. will likely be modest, it does introduce an element of global uncertainty at a time when capital spending is already weak.

Although Brexit took center stage this quarter, there were other economic concerns that impacted the markets. U.S. job growth became a concern when just 38,000 net new jobs were created in May, the slowest monthly pace since May 2010. June’s report quieted those fears as employers added 287,000 jobs, the strongest monthly gain since October. Despite this, the quarterly average was 147,000 jobs per month which was significantly below last year’s average pace of 229,000 and perhaps a sign the jobs market is becoming saturated. Consumers painted a more positive picture of the economy as retail sales hit a 12-month high in April and showed modest growth in May. Factors such as relatively low energy prices, rising home prices, wage growth and a tight labor market allow consumers to be the drivers of U.S. growth. U.S. equities were also supported by rallying energy prices this quarter, as oil prices rose during the quarter amid hopes that major oil producers might agree to a round of production cuts or at least freezes. While no agreement was reached, hopes that there will be future production cuts, and a falling U.S. dollar (oil is priced in dollars), helped push the price of oil higher and energy company stocks followed suit.

Fixed income continued its impressive 2016 performance as the benchmark 10-year U.S. treasury yield fell from 1.77% at the start of the quarter to close at 1.47%. The 10-year yield dipped to a record low of 1.34%, as investors rushed into the relative safety of U.S. treasuries following the Brexit vote. For the quarter, the performance of U.S. treasuries led the way followed by high yield, emerging markets and global bonds. The fact remains that U.S. treasury yields are still substantially higher than yields on other high-quality global sovereign debt (UK 10-year notes fell below 1% and German 10-year yields joined Japanese 10-year yields in negative territory), which continues to push investors into U.S. government debt. Expectations of a Fed rate hike have been pushed out several months and perhaps even into 2017. I would expect December to be the likely candidate as that will allow the Fed to know the results of the election and get a few more data points on unemployment. This is the longest period in 40 years between the first and second rate hike, assuming we even get one. Not since March 1997 have we had a one-and-done period when we did not get a second rate hike before the next cut.

International equities had mixed results this quarter, punctuated of course by the volatility surrounding the surprise Brexit vote. After an up and down start to the quarter, European equites sold off sharply following the Brexit vote and markets were further shaken when UK Prime Minister David Cameron announced he would resign by October. Despite these unprecedented moves, most European markets recovered much of their losses by the end of the quarter. The governor of the Bank of England stated that he expects the UK exit will cost the Eurozone 0.5% of gross domestic product over the next three years. However, many investors anticipate a beneficial impact to UK equities from a weakened currency due to its predominately overseas earnings base. Europe as a whole is supported by aggressive quantitative easing policies by central banks and low energy costs, which should help offset other issues such as high unemployment, geopolitical volatility, and elevated debt levels.

Emerging markets proved resilient amid the volatility, rising on the back of advancing oil and commodity prices which supported resource-driven and energy exporting emerging economies. Chinese stocks finished roughly flat for the quarter as recent data suggest slowing growth in the second quarter from the first quarter’s 6.7% rate. There are concerns about how much stimulus the government will provide to sustain growth and the high levels of debt on Chinese corporate balance sheets. Despite this, emerging market stocks were mostly higher with ascending commodity prices and easy monetary policies across the globe helping to push gains.

The primary concern among most investors heading into 2016 was the potential for more Fed rate increases. The immediate fallout of Brexit impacts the central banks across the globe. Those that were adding stimulus are now adding more (BOJ); those that were on the fence are now cutting rates (ECB); and those that were close to rising rates are now on hold (Fed) or even likely to cut instead (BOE). Although we have seen elevated market volatility, the increased probability of additional central bank stimuli could put a damper on any moves to the downside. However, we would still like to see improved economic and corporate earnings growth before getting too excited about asset prices at the current levels. The continued appetite for bonds suggests that investors are still nervous about the potential for market disruptions, especially with S&P 500 companies on track to record a fifth consecutive quarter of declining earnings growth, led by declining energy company earnings.

In this low-rate environment punctuated by unpredictable geopolitical events and modest economic growth, we shall remain diversified in our approach to asset allocation while looking for occasional opportunities. Finally, since we are fielding a lot of questions about this already: should Mr. Trump win the election that will be worse for the markets. This is not a political statement, just that the markets hate uncertainty, and a Trump Presidency is more uncertain than a Mrs. Clinton one. Therefore, as the election nears, if the polls are close, or show Mr. Trump in the lead, stocks will likely be more volatile than if Mrs. Clinton is ahead by double digits. That said, either one will still have to deal with Congress; a likely GOP controlled House (and possibly Senate as well), will limit the amount of change that can really occur.