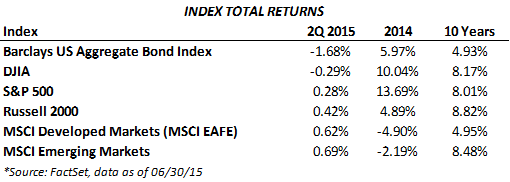

Domestic equities finished the second quarter relatively unchanged, as better than expected corporate earnings and enthusiasm surrounding a reaccelerating U.S. economy were balanced by concerns over the Greek debt crisis and Chinese market volatility. Despite volatility abroad due to global issues, international and emerging markets finished slightly positive for the quarter.

There was some concern regarding earnings in April, as investors feared that falling energy prices and a stronger dollar would negatively impact corporate earnings. Despite these headwinds, many companies reported that earnings had not declined as much as analysts had expected. According to FactSet, at the start of the quarter analysts expected earnings to decline 4.7% from the previous year, but when final results were tallied corporate profits of S&P 500 companies had actually increased 0.8%. Though this was the slowest growth rate in over two years, the earnings growth rate would have been much higher had it not been for the plunge in energy sector profits.

US treasuries experienced their first quarterly loss since 2013, as the 10-year yield rose from 1.92% to 2.34% at quarter end. Expectations of an imminent Fed rate hike outweighed a safe-haven flight to U.S. treasuries from investors concerned about a Greek default. We saw a stronger-than-expected May employment report and other data that indicated the economy continued to improve. More positive data from the U.S. economy will put additional pressure on the Fed to hike rates by the end of the year.

International markets posted modest gains for the quarter, with a strong rally early in the quarter doused by concerns about Greek spillover effects. It became apparent late in the quarter that Greece would be the first developed economy to miss a payment to the IMF. The Greek government took austerity measures, temporarily closing its banks and stock markets, and imposing capital controls limiting the amount of withdrawals from ATMs. The Greek stock market plunged on the news and the broader European market fell over 5% in the last week of June. While the future path of Greece remains uncertain and an exit from the Eurozone is possible in the future, the real concern is the potential negative impact on global markets and resultant increase in volatility.

While the Greek economy is small in both absolute and relative terms, with 11 million citizens accounting for approximately 3% of total Eurozone output, a debt default and exit from the single Euro currency could have global implications. This would not be an issue if the question were one solely of economics. Rather it is political. Should Greece leave the EU, the primary concern is contagion—or “which country is next?” If Greece experiences massive pain, then perhaps the contagion is contained. However, if they rebound after being able to shed their debt, why would Italy, Spain or Portugal want to continue to suffer the downdraft of their own debt loads? It is likely there would be pressure within those countries to follow suit. That is a longer-term issue as the fallout of Greece leaving, if they do, would not be known for a few years. The current uncertainty in Europe seems to be under control for now, but will likely rise up again when Greece burns through the latest bailout money. The good news is the ECB has done a lot of work to create better protective barriers than what existed the last time we had a Greek crisis in 2012.

The volatility in the Chinese markets hit at the same time as the latest edition of the Greek Debt crisis. Chinese stocks had an extraordinary rise this year, more than doubling, followed by a 20% decline in 2 weeks from the June 12 peak, prompting Chinese officials to freeze their stock market (meaning not allowing the stocks to trade) in an effort to reduce selling pressure. At one point apparently only 3% of all Chinese stocks were openly trading, the rest either frozen by the government, or halted due to reaching 10% daily circuit breaker levels.

The strategy temporarily worked but likely puts more selling pressure on the stocks that are still liquid. This was the latest in a string of attempts to prop up the stock market (including cutting deposit rates, lending rates and bank reserve requirements, relaxing trading fees, and outright buying equities). It is disturbing that Chinese stocks continue to fall in the face of overwhelming government support, but at the same time, is it surprising that a major market doubling in a year is experiencing a violent correction? One needs to remember the vast majority of investors in China, meaning the Chinese, are novice investors trading on margin—a very bad combination.

The price of oil has been declining steadily the last month or so. The most disturbing thing in our opinion is that after the rig count reduced by about 50%, while oil fell from $110/bbl to $45/bbl, production stayed fairly strong. This is a testament to the efficiency of the modern day well, as well as proof the best plays are the last plays to be taken off line. Additionally, as soon as oil creeped back into the upper $50s, a few wells started coming back online. This, to us, does not imply that the bottom has been reached in oil prices, and wells should not be coming back online so quickly unless someone thought oil was definitely heading higher. Meaning we are concerned there are too many oil bulls out there, given the fact oversupply has not come down that much and demand has not increased much.

Finally, interest rates have taken a back seat to the global issues (thank goodness—I don’t know about you, but I am tired of so much attention on the Fed) but the speculation is the Fed has a pretty strong reason to push back the first hike if Greece and China are still causing that much instability. We are more of the opinion the Fed is looking to normalize rates, perhaps getting to 1% and then waiting to see what happens. We think the Fed should raise rates; it would be nice if they had a couple bullets in the gun in case China or some new threat gets really ugly. That said, given how dovish (meaning against raising rates) the Fed appears, so long as there is not significant inflation, especially wage inflation, the Fed does not have to move.

Greece seems to be resolved for now, but we would not be surprised if the sentiment lingers a little while; slowing growth in China remains a challenge– GDP growth slowed to 7% year-over-year—while the official numbers can be debated, the slowing of them cannot. This will continue to be felt in the worldwide economy as well. The price of oil continues to experience downward pressure and we are but one meeting away from a possible Fed Funds rate hike in September. These factors have certainly added volatility into the stock and bond market. While we believe a correction in values to be somewhat overdue, the most appropriate protection against a correction remains periodic rebalancing and broad diversification across asset classes.