I had the privilege of hearing Karl Rove speak recently. I know many of you follow politics very closely and I thought it would be interesting to relay my impressions from his speech. For those of you on the younger end of the newsletter readership or who do not follow politics that closely, Karl Rove is a Republican political consultant and policy advisor. He was Senior Advisor and Deputy Chief of Staff during the George W. Bush administration.

Given that introduction you might imagine Mr. Rove was leaning considerably to the right in his opinions. He began with his take on Obamacare, of which unsurprisingly, he was not a supporter. I will spare you the details of his disdain, but he did say that the real problem with the lack of younger people signing up (younger people pay premiums but don’t use their coverage a lot statistically, therefore the younger people essentially pay for the coverage of the older folks who statistically rely on insurance far more) is that once the deadline is reached—a somewhat nebulous issue given the multiple extensions already—the actuaries of the underlying insurance companies will review the actual statistics of the enrollees vs. the estimated results. When they find the average age of enrollees is considerably higher than expected, we will see a dramatic increase in premiums. Mr. Rove thinks that after all this political posturing, money spent, extensions filed, etc. only 1 million more people will have health insurance.

The other big issue this year will be the Federal Budget. Congress recently passed a budget for fiscal year 2014, so the debate now is for FY2015. Mr. Rove expects an increase of 16% to the budget, but the battle will be over the part allocated to national defense. Historically, this number has been about 4% of GDP, but the proposal for FY2015 is 1.9%. Given the recent Ukraine/Russia situation, this may create significant debate. Mr. Rove was actually very vocal in his critique on Russian President Putin. He referred to him repeatedly as a “KGB thug” and said President Bush was early in figuring that out. He believes Mr. Putin has been probing for weakness and that President Obama’s action has given Mr. Putin a chance to push his agenda and that Mr. Putin will continue to push for power and territory. Mr. Rove thinks the best way to deal with that situation is to increase sanctions, increase aid to Ukraine—specifically arm and train the military and get Europe involved—and to approve LNG exports. While taking years to get up and running, just the approval should drop global energy prices.

Mr. Rove stated the midterm election of a President in his second term usually goes against the party of the President, especially when that President’s approval rating is below 50%. As President Obama’s approval rating is well south of that Mr. Rove believes the GOP will enjoy a sizable victory in November. In fact the only thing preventing a landslide victory is that the House already has a sizable Republican majority; nevertheless, they should pick up 3-5 seats. The Senate is a little different: Mr. Rove thinks the key races will be in KY, GA (key blue states); WV, SD, MT (red states with Democrat incumbents); NH and CO (blue states with strong GOP challengers); and MN, OR, IA and VA (toss ups at this point).

Finally, in discussing the 2016 Presidential election, the biggest topic Mr. Rove covered was the fact this race will define the GOP for years to come, and arguably the very future of the party itself. There is currently no frontrunner and literally 10 candidates could emerge. He thinks Governor Christie will emerge stronger from the bridge scandal, but maybe not strong enough. He thinks Jeb Bush and Marco Rubio are such good friends that one of them will run, but not both. The Republicans will have to choose between being the party of Ronald Reagan or the party of the last few elections that has taken a far right stance.

I found Mr. Rove’s speech to be very entertaining and informative. For those of you from Colorado, he is actually a native, having been born here, although growing up in Texas.

The Quarter in Review

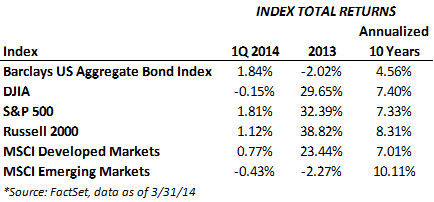

U.S. equities made modest gains during the 1st quarter, as the S&P 500 touched record highs before closing out the quarter with a total return of 1.8%. Equities faced a challenging environment as geopolitical turmoil in Ukraine, concerns about growth in emerging markets, and softer data in the U.S., at least partially due to weather, created a more volatile investing environment. The first quarter economic reports were given a “get out of jail free card” due to the impact of the severe weather conditions. It will likely be well into the second quarter before we know if that impact was indeed temporary. Although consumer confidence in the U.S. reached a 6-month high, 4th quarter GDP was revised down to 2.6% from an initial estimate of 3.2%, the unemployment rate ticked up to 6.7%, and housing data, especially residential construction and home purchases, was generally disappointing.

The best gains during the quarter by sector came from utilities (9.9%) and healthcare (5.8%) while consumer discretionary (-2.8%) and telecom (-0.1%) lagged. Investors also began to question the lofty valuations of some of the high-flying momentum stocks, as shares of Amazon fell 16% during the quarter and Netflix fell 22% in March to close the quarter down 4.4%. It will be interesting to see if the rotation from expensive growth stocks to value stocks continues, as these trends in large part will depend on the quality of the upcoming earnings season.

In the fixed income world, bonds rallied during the quarter amid tensions in Ukraine and disappointing economic data in the U.S. and China. The bond rally was aided by the continuation of dovish Fed policies under new Fed Chairwoman Janet Yellen, who assumed leadership of the Fed in early February. The yield on the benchmark 10-year Treasury bond fell 31 basis points to close the quarter at 2.72%, and the Barclays Aggregate Bond Index gained 1.84%, slightly outperfoming the S&P 500.

The Fed continued to reduce its asset purchase program by $10 billion per month. At her first testimony before Congress, Ms. Yellen signaled that rates would remain low for a long time and no changes would be made to the schedule of quantitative easing. She also stated the Fed changed its stance on the 6.5% unemployment target as the mark to begin raising its interest rate target above zero. Instead, Ms. Yellen indicated that rates will remain near zero well past the time the unemployment rate drops below 6.5%, and the Fed will instead focus on a broad range of economic measures, especially as long as inflation remains below 2%. Separately, Congress approved a deal to raise the government’s debt ceiling until March 2015 with no strings attached, which gave markets relief after the October 2013 government shutdown.

Emerging market stocks ended the quarter down slightly as concerns over tensions between Russia and Ukraine and slowing economic growth in China, especially fears about the health of the country’s banking system, weighed on investor sentiment. The Russian military occupied the Ukrainian peninsula of Crimea, which then voted to secede from Ukraine to join Russia. Western world leaders declared the referendum illegal and penalized Russia with sanctions and the threat of additional trade sanctions. The situation remains fluid and contributed significantly to market volatility during the quarter.

Emerging markets were also impacted by slowing growth in China, as the country’s manufacturing PMI fell into contraction territory at 48.5 in February, the lowest level in seven months. China also saw its exports fall 18.1% year over year in February, as Chinese leaders attempt to restructure the economy to focus on increasing household consumption and decreasing reliance on manufacturing and exports. Though absolute levels of growth in emerging markets remain above growth levels in developed markets, the trajectory has been downward and concerns over declining growth rates negatively impacted emerging market equities during the quarter. The bottom line on China is that so far they seem to be orchestrating a smooth transition from an export based economy to a consumer led economy. This has a while to play out but the early signs are positive.

Though the 1st quarter saw increased market volatility due to weather-influenced economic data, geopolitical tension in Ukraine, and concerns about emerging market economies, there are positive signs that the underlying US economy is improving. Strong corporate profitability, low debt levels, and companies flush with cash may lead to a rebound in business investment and continued M&A activity. Companies continue to enjoy record low interest rates on debt, and while payroll gains have been moderate I would wager we are still a couple years away from anything resembling wage pressure. This should allow record profit margins to persist for a few more years.

Last quarter we stated the benefits of diversification, which didn’t work in 2013, would eventually return and that volatility would increase. Well, we only had to wait one quarter as bonds outperformed stocks in the US and volatility jumped. Granted we remain cautious on bonds as we expect interest rates to continue to rise, but this illustrates why adherence to long-term investment goals is important. Going forward, we expect international and emerging markets to hold good value for the long-term and continue to like companies with increased dividend paying capabilities.